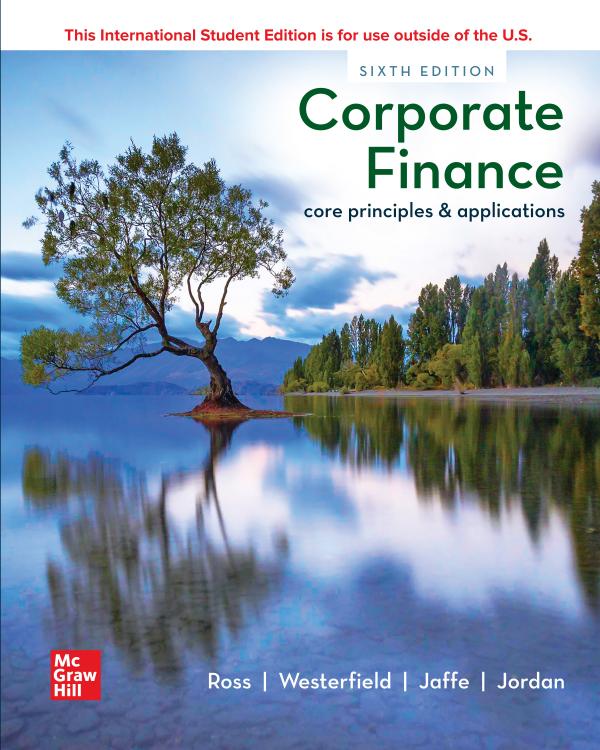

CORPORATE FINANCE 6ED

Core Principles & Applications

Stephen A. Ross , Randolph W. Westerfield , Jeffrey F. Jaffe y Bradford D. Jordan

Editorial: McGraw-Hill Higher Education

Edición: 6

Fecha Publicación: 2021

ISBN: 9781260571127

ISBN ebook: 9781260589825

Páginas: 737

Grado: Universitario

Área: Economía y Empresa

Sección: Business

Idioma: Inglés

Tweet

Tweet

Edición: 6

Fecha Publicación: 2021

ISBN: 9781260571127

ISBN ebook: 9781260589825

Páginas: 737

Grado: Universitario

Área: Economía y Empresa

Sección: Business

Idioma: Inglés

Tweet

Tweet

Part One. Overview

Chapter One. Introduction to corporate finance

Chapter Two. Financial statements and cash flow

Chapter Three. Financial statements analysis and financial models

Part Two. Valuation and capital budgeting

Chapter Four. Discounted cash flow valuation

Chapter Ffive. Interest rates and bond valuation

Chapter Six. Stock valuation

Chapter Seven. Net present value and other investment rules

Chapter Eight. Making capital investment decisions

Chapter Nine. Risk analysis, real options, and capital budgeting

Part Three. Risk and return

Chapter Ten. Risk and return: lessons from market history

Chapter Eleven. Return and risk: the capital asset pricing model (CAPM)

Chapter Twelve. Risk, cost of capital, and valuation

Part Four. Capital structure and dividend policy

Chapter Thirteen. Efficient capital markets and behavioral challenges

Chapter Fourteen. Capital structure: basic concepts

Chapter Fifteen. Capital structure: limits to the use of debt

Chapter Sixteen. Dividends and other payouts

Part Five. Special topics

Chapter Seventeen. Options and corporate finance

Chapter Eighteen. Short-term finance and planning

Chapter Nineteen. Raising capital

Chapter Twenty, International corporate finance

Appendix A. Mathematical Tables

Appendix B. Solutions to Selected End-of-Chapter Problems

Appendix C. Using the HP 10B and TI BA II Plus Financial Calculators

*La edición digital no incluye códigos de acceso a material adicional o programas mencionados en el libro.

Corporate Finance: Core was developed for the graduate (MBA) level as a concise, up-to-date, and to-the-point product, the majority of which can be realistically covered in a single term or course. To achieve the objective of reaching out to the many different types of students and the varying course settings, corporate finance is distilled down to its core, while maintaining a decidedly modern approach. Purely theoretical issues are downplayed, and the use of extensive and elaborate calculations is minimized to illustrate points that are either intuitively obvious or of limited practical use. The goal was to focus on what students really need to carry away from a principles course. A balance is struck by introducing and covering the essentials, while leaving more specialized topics to follow-up courses. Net present value is treated as the underlying and unifying concept in corporate finance. Every subject covered is firmly rooted in valuation, and care is taken throughout to explain how particular decisions have valuation effects. Also, the role of the financial manager as decision maker is emphasized, and the need for managerial input and judgment is stressed.

Massachusetts Institute of Technology

Randolph W. Westerfield

Marshall School of Business

University of Southern California

Jeffrey F. Jaffe

Wharton School of Business

University of Pennsylvania

Bradford D. Jordan

University of Kentucky

Libros que también te pueden interesar

MÉTODOS DE COMPRA

* Precios con IVA

Busca el término o términos dentro de cada uno de los libros